Login

Authenticating...

Authenticating...

Press the Windows logo key  +PrtScn. The file is saved to the Screenshots folder in your Pictures folder. You can also us the Snipping Tool which is available in all versions of Windows Vista, 7, and 8 except the Starter and Basic editions.

+PrtScn. The file is saved to the Screenshots folder in your Pictures folder. You can also us the Snipping Tool which is available in all versions of Windows Vista, 7, and 8 except the Starter and Basic editions.

To take a screenshot with your Mac, Command + Shift + 3 and then release all keys to captuer the whole screen, or press Command + Shift + 4 and press down and drag the mouse over the area you'd like to capture.

To take a screenshot with your iPhone or iPod Touch, press and hold the sleep/wake button and then click the Home button.

Take a Screenshot with Android 4.0 (Ice Cream Sandwich) just press and hold the Volume Down and Power buttons at the same time.

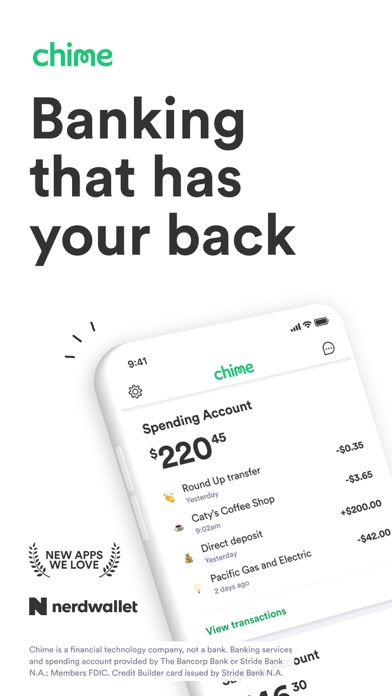

Chime is the banking app that has your back. Keep your money safe with security features, overdraft up to $200 fee-free*, and get paid up to 2 days early with direct deposit^, with no hidden fees‡.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A.; Members FDIC

TRUSTED BY MILLIONS

Stay in control of your money with two-factor authentication, TouchID, or FaceID. Enable instant transaction alerts and daily balance updates, and block your card in a single tap.

OVERDRAFT UP TO $200*

We get it– when your balance is running low, the last thing you need is a $32 overdraft fee. Eligible members on Chime can overdraft up to $200* on debit card purchases with no fees.

SAY GOODBYE TO HIDDEN FEES‡

Your account shouldn’t cost you money. Chime has no monthly maintenance fees, minimum balance fees, or foreign transaction fees. Plus, access 60k+ fee-free ATMs at locations like Walgreens, 7-Eleven, CVS, and more.

GET PAID UP TO 2 DAYS EARLY

Get your paycheck up to two days early^ with direct deposit, earlier than you would with some traditional banks.

MEET CREDIT BUILDER, A NEW WAY TO BUILD CREDIT

Whether it’s for gas or groceries, use Credit Builder¹ to help increase your credit score by an average of 30 points² with regular on-time payments.

No interest, no annual fees, no credit check to apply.

REACH YOUR MONEY GOALS

Save money without even thinking about it. Automatic Savings features help you save money any time you spend or get paid.

PAY FRIENDS WITH NO TRANSFER FEES

Send money to friends, family, or roommates as fast as a text – with no transfer fees.

–––––

Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. The Chime Visa® Credit Builder Card is issued by Stride Bank pursuant to a license from Visa U.S.A. Inc. Debit card and Credit card may be used everywhere Visa credit cards are accepted.

*Chime SpotMe is an optional, no fee service that requires $500 in qualifying direct deposits to the Chime Spending Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. SpotMe won't cover non-debit card purchases, including ATM withdrawals, ACH transfers, Pay Friends transfers, or Chime Checkbook transactions.See terms and conditions.

‡Out-of-network ATM withdrawal fees apply except at Moneypass ATMs in a 7-Eleven location or any Allpoint or Visa Plus Alliance ATM. ATM withdrawals will be fee-free at all Moneypass ATMs until at least August 7, 2021. Other fees such as third-party and cash deposit fees may apply.

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

¹To be eligible to apply for Credit Builder, you need to have received a qualifying direct deposit of $200 or more to your Spending Account within 365 days of your Credit Builder application. See chime.com/applycb for detail on qualifying direct deposit.

²Based on a representative study conducted by TransUnion®, members who started using Chime Credit Builder in September 2019 observed a median credit score (VantageScore 3.0) increase of 30 points by January 2020. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

Our developers are amazing. In fact, I’m so impressed with their weekly bug fixes and performance improvements that writing these updates isn't enough for me—I also give verbal app-updates to my friends. I’ll tell them how each week the Chime devs do so many cool things, like upgrading UI components or giving the ChimeBot an oil change. Normally people respond with blank stares (due to their excitement I’m guessing) or say things like “Sir, this is an Arby’s”. I’m just doing my part.

It looks like you are using an ad blocker. We understand, who doesn't? But without advertising income, we can't keep making this site awesome.